The blockchain technology trends 2026 are leaving the hypothetical hype behind. What was previously linked with the cryptocurrency is currently turning into a necessary infrastructure of various industries, including finance and healthcare, supply chain management, etc. Decentralized systems are being utilized to improve security, transparency, and efficiency by businesses. In the approaching year 2030, these trends are important in order to remain competitive within a digitized ecosystem.

This article focuses on the best blockchain technology trends 2026, the application of the technology in practice, and how firms are using it to provide solutions to real-life challenges.

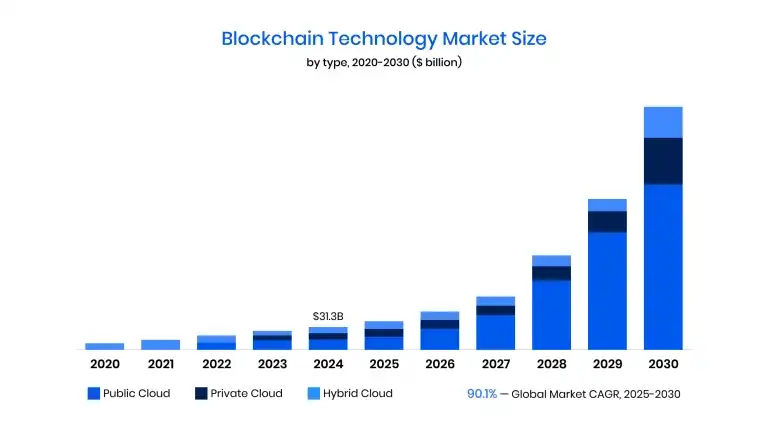

Growth of the Blockchain Market

The market growth is huge and serves as the support of the blockchain technology trends 2026. In contrast to the earlier hypes, the current hype is stable and enterprise-based. Recent studies suggest that the global blockchain market will increase by a compound annual growth rate (CAGR) of more than 85% in the year 2024 to 2030. This is driven by the need to have secure, transparent systems in the finance, logistics, energy, and healthcare sectors.

The U.S. is in the lead with regulatory assistance and investment based on innovations; meanwhile, the fastest-growing sector is Asia-Pacific, with countries such as China, Japan, and India establishing blockchain in trade and in the services sector. Europe is also lagging behind, and rules such as MiCA make cross-border adoption easier.

With the expansion of blockchain technology as a niche application to infrastructure, business organizations should adapt to these changes to remain competitive.

Top 5 best blockchain development trends 2026

1. Modular Blockchain Architectures

One of the trends of blockchain technology in 2026 will be the emergence of modular blockchain architecture. Modular blockchains provide a separation of functions between execution, consensus, and data availability, unlike more traditional monolithic chains. This enables developers to design custom networks that can be used in particular scenarios and save on expenses and improve efficiency.

As an example, Celestia has introduced a modular mainnet of data availability where rollups can be scaled without physically executing a layer 1. On the same note, Polygon 2.0 will adopt zero-knowledge (ZK) technology to allow multichain transactions. Modular architectures can now give startups the ability to run fast, compliant networks with specialized finance, identity, and logistics features.

2. Zero-Knowledge Proofs at Scale

Blockchain privacy and scalability are changing with zero-knowledge proofs (ZKPs). They enable one to verify information without exposing the underlying information, which is essential in controlled industries. ZK rollups are already being used in high volumes by layer 2 networks, including zkSync Era and Starknet.

Polygon zkEVM adds Ethereum support to ZKPs, and companies such as Visa have experimented with ZK-based auto-payments, which would preserve privacy and compliance at the same time. These systems are also being considered by governments as a way of safe, anonymous online voting.

Through the implementation of ZKPs, businesses can not only enjoy privacy but also enjoy speed in transactions and less overhead in infrastructure.

3. Real-World Asset Tokenization

One of the most physical trends of blockchain technology in 2026 is tokenization of real-world assets (RWA). Fractional ownership, liquidity, and visibility of transaction Whether of bonds or real estate, blockchain can make commodities.

BlackRock has created a tokenized US treasury holdings fund, the BUIDL Fund, and has raised $240M, and an HSBC trading platform tokenized gold has been launched. Even energy markets are going blockchain, with sites such as SunContract permitting peer-to-peer electricity trading.

Transforming the physical and financial world into digital tokens, blockchain connects the traditional markets to the decentralized infrastructure, releasing the value in the trillions and transforming the investment paradigm.

4. Blockchain for Digital Identity and Compliance

The issue of digital identity is growing more crucial. Identity solutions on blockchain allow safe, verified, and self-sovereign credentials. Businesses and governments are investing in such systems to simplify the verification process and achieve regulatory needs.

The EBSI program of the EU allows cross-border credential verification, Worldcoin provides proof-of-personhood with biometrics, and Polygon ID uses ZKPs to provide private credentials. Identity solutions based on blockchain are not only needed in the fintech KYC processes but also in e-government, academic identity validation, and healthcare compliance.

A solid identity structure will bolster trust, mitigate fraud, and establish the foundation of scalable digital services.

5. Blockchain as Infrastructure for AI

One of the most exciting blockchain technology trends of 2026 is using blockchain as the backbone for AI agent development. With the widespread use of AI, the issue of data provenance, the transparency of models, and trust become significant. The answer to this problem should be blockchain, as it offers decentralized and verifiable data, transactions, and AI behavior records.

Such projects as Ocean Protocol permit the use of safe data exchange in the process of AI training, Fetch.ai incorporates autonomous agents with on-chain coordination, and Bittensor provides AI models to coordinate in decentralized systems. Such integrations enable businesses to implement AI models more effectively, without causing accountability and transparency to automated systems.

In parallel, enterprises are exploring cloud solutions that integrate blockchain to handle large-scale data, enabling decentralized compute and seamless collaboration across geographies.

Blockchain Trends Across Industries

Financial Services

Blockchain remains conquered by financial institutions. Blockchain is changing payments, remittances, and management of digital assets with stablecoins, such as the USDC, and CBDCs, such as the Digital Yuan in China. Banks and fintech firms are moving towards the adoption of blockchain in the future to improve the effort in streamlining operations and become more secure.

Healthcare

Blockchain boosts the security of patient data and improves the billing process and pharmaceutical supply chain integrity. The growth of the global blockchain healthcare market is expected to be booming up to 2030 due to the compliance with GDPR and interoperability of electronic health records (EHRs).

Retail and Supply Chain

In retail industries , the retailers are employing blockchain in order to guarantee transparency, prevent counterfeiting, and build customer confidence. Fashion brands such as Gucci are moving to blockchain payments, and logistics providers are using tokenized tracking systems to streamline their businesses.

Media and Entertainment

Blockchain also fights piracy, guarantees the distribution of content, and ensures equitable payment to creators. In 2026, platforms that delve into media services based on blockchain are becoming common.

Education

Blockchain protects educational history, authenticates qualifications, and lessens the amount of administration. Lifelong learning certificates can now be stored in a decentralized ledger, which is immutable and accessible on platforms.

Overcoming Adoption Challenges

While blockchain technology trends for 2026 are promising, adoption faces challenges:

- Legacy systems: Integration needs modular thinking and API-based integration.

- Lack of experience: By collaborating with a blockchain development company, one will be vulnerable to hired architects and programmers.

- Extended development cycles: Agile development and targeted pilot projects are useful to provide initial value.

- Regulatory ambiguity: Regulatory frameworks such as MiCA and GDPR inform the secure enforcement.

- ROI expectations: Pay attention to operational efficiency and transparency and not short-term returns.

AI and Machine Learning Integration

Beyond infrastructure, AI/ML development combined with blockchain enables predictive analytics, automated decision-making, and the execution of contracts. Stakeholders in the enterprise may use blockchain-authenticated data in robust AI training to promote transparency and trust in models.

With AI and decentralized systems, businesses achieve competitive advantages in efficiency, risks, and regulatory compliance.

Final Thoughts

The trends in blockchain technology in 2026 are transforming not only the financial industry but also the supply chain and healthcare industries, among others. What used to be a speculative infrastructure has turned into enterprise-critical infrastructure. Firms that embrace these technologies at an early stage are able to save money, increase transparency, and create stronger digital ecosystems.

Nextwisi Solutions provides end-to-end blockchain development solutions, such as smart contracts, decentralized applications, and tokenizing assets, to businesses interested in using such trends. By collaborating with one of the reliable providers, you also make sure that your organization is on the frontline and is maximizing the potential of blockchain technology trends in 2026.

Leave a Reply