The blockchain technology has created new financial, gaming, supply chain, and digital identity opportunities. Nevertheless, networks have one significant constraint as more users connect with decentralized applications, and that is scalability. The transaction fees get higher, the confirmations are delayed, and the user experience is poor. This question is why many developers and businesses are raising a significant question: Which rollup service is best for blockchain projects that want speed, security, and cost efficiency at the same time?

The rollup has become one of the most potent scaling proposals within the blockchain ecosystem. They shift the execution of transactions out of the main chain but use it to secure and finally settle the transaction. In this article, you will learn what rollup services are and how simple they are, choose the primary alternatives in the market today, and determine which strategy will meet the long-term objectives of your blockchain project.

What Is a Rollup in Blockchain?

A rollup is a scaling approach in Layer 2, which sends several transactions together in a batch, which is then sent to the primary blockchain as a compressed block or cryptographic verifiable. Rollups do not directly process each transaction at the base layer but do computation off-chain and post only essential information to the on-chain.

This design has a number of advantages. It minimizes the main network congestion and transaction costs, enhances throughput, and ensures decentralization and security. Due to the benefits, rollups are now common in decentralized finance platforms, NFT ecosystems, game networks, and enterprise blockchain systems.

Why Rollup Services Matter for Modern Blockchain Projects

With increasing adoption, blockchain applications are expected to behave like the conventional web apps. They desire quick confirmations, cheap prices, and hassle-free interfaces. Rollup services also offer infrastructure that would enable developers to fulfill these expectations without compromising on trust or transparency.

It also has advantageous predictable business transaction costs, enhanced scalability, and enhanced data integrity in businesses. Rollups can turn blockchains into a workable size, whether the purpose of implementing them is to process thousands of micro-payments or support real-time gaming actions.

Types of Rollup Services Available Today

There are varying rollup models since the blockchain projects may require different needs. Others are more concerned with security, others desire faster finality, and some demand that they have full control over their infrastructure.

Optimistic Rollups

Optimistic rollups expect all transactions to be valid, except when a fraud proof is presented by someone. This algorithm lowers the cost of computation and permits significant throughput at a fairly low cost.

They are also compatible with the majority of Ethereum tools and smart contracts, which is why developers are likely to like them. These rollups are effective with decentralized applications of user engagement, NFTs, and interactive applications.

Withdrawals can however take a longer duration due to the dispute window. This may be a weakness of applications that demand immediate settlement.

ZK Rollups

ZK rollups are cryptographic proofs to confirm transaction batches that use zero-knowledge cryptography. They do not believe in assumptions but mathematically establish that every transaction is valid, and only after it is validated on the main chain is it final.

This method offers more security and speedy withdrawals. It particularly fits well in financial systems, enterprise platforms, and applications containing sensitive information. ZK rollups are streamlined when it comes to large-scale transactions and scalability.

Complexity of development is the greatest difficulty. The process of generation of proofs involves high levels of cryptography, and the tooling is in progress as compared to optimistic systems.

App-Specific Rollups

Other blockchain initiatives choose to create their own bespoke rollups for their specific needs. These application-specific rollups enable the team to manage the rules of transactions, performance, and data availability layers.

They can be used in cases whereby businesses require freedom, flexibility in regulations, or specialized logic. Supply chain systems or enterprise networks can be an example of systems that could be supported with tailored throughput and a governance model.

The negativity is increased engineering work. Maintenance, upgrades, and security are issues that teams have to address without big common ecosystems.

Rollup-as-a-Service (RaaS)

The Rollup-as-a-Service platforms are ready-to-use tools that are able to start a rollup network within minutes. The developers do not have to make everything on their own; they use managed infrastructure, which permits configuration settings.

These are services that are appealing to startups and businesses seeking quicker and simpler deployment with little blockchain engineering. They can also be customized as they manage the complexity of operations in the background.

The dependency on the provider and the constant cost of service is the trade-offs. The reason to use this route is to focus on long-term planning.

Which Rollup Service Is Best for Blockchain Projects Based on Use Case

The selection of an appropriate rollup is based on the performance objectives, security objectives, and the available resources. No universal answer exists, but definite trends can be seen at real-life implementations.

Consumer-interaction-oriented projects tend to use optimistic rollups due to their low fees and due to the ability to interact with preexisting smart contracts. Financial platforms and payment systems are more inclined to use ZK rollups because of the speed of settlement and cryptographic guarantees. Compliance and customization App-specific rollups or RaaS platforms may be used by enterprises and controlled industries.

That is why this question, “Which rollup service is best for blockchain projects?” should be answered with the help of the analysis of the audience of the project and the number of transactions, as well as the further perspectives of the project.

Key Factors to Compare Before Choosing a Rollup

Performance and Speed

Finality and efficient throughput are typically offered in ZK rollups. Most applications do well with optimistic rollups, but the recovery time is slower. Workloads that are unique can be optimized to app-specific rollups.

Security Model

Proofs of validity in ZK rollups provide good mathematical guarantees. The evidence of fraud in optimistic systems is based on challenge mechanisms. Security RaaS is based on the rollup stack chosen.

Development Effort

Optimistic rollups have the advantage of well-developed developer tools. ZK rollups involve a high level of cryptography expertise. Unless deployed as managed services, app-specific rollup requires skilled engineering teams.

Cost and Maintenance

All rollups save transaction fees as opposed to main chains. RaaS services create an additional cost to the operations but decrease the overhead. Tailor-made rollups need internal knowledge and a long-term maintenance strategy.

Real-World Use Cases of Rollup Services

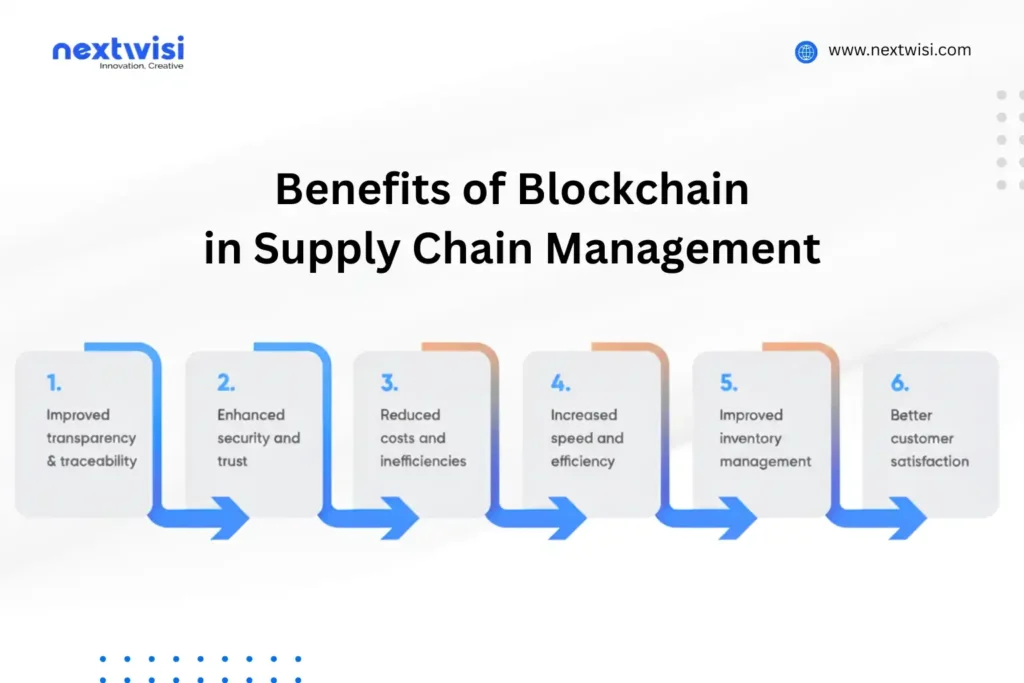

Thousands of player actions are processed by rollups per second at no high gas costs on gaming platforms. Solutions under the supply chain embrace rollups to ensure verifiable tracking and auditability. Financial services also use rollups to enhance the speed of a transaction without the loss of trust. Enterprise systems are advantaged by the use of the private or semi-private rollup design to balance performance and compliance.

These instances illustrate the manner in which rollups can fit in various industries without compromising on the fundamental benefits of blockchain.

Common Mistakes When Selecting a Rollup

Most of the projects do rollups depending on popularity instead of necessity. Others neglect maintenance over the long term or do not take the complexity of development into account. The other similar problem is neglecting withdrawal time limits, which may impact user trust and liquidity.

To prevent these errors, it is necessary to perform technical information analysis, user experience analysis, and scalability prediction.

Final Recommendation

The answer to the question Which rollup service is the best to use on blockchain projects is not a one-size-fits-all answer because each of these solutions suits a particular requirement. ZK rollups are of great security and speed. Optimistic rollups are simple and support ecosystems. The highest control is offered with app-specific rollups. RaaS solutions provide rapid implementation and less work on infrastructure.

It is best to align your rollup option with your business model, user expectations, and strategy of growth.

Conclusion

Rollups are considered one of the key tools to scale blockchain applications in a viable and sustainable manner. They enable developers to have decentralization and provide users with cheap and quick transactions. With the further rise in the use of the blockchain, the performance, trust, and user experience will depend on the selection of the appropriate rollup service directly.

Once the strengths and weaknesses of each rollup model are known, it becomes easier to create systems ready to operate in the future. Regardless of what type of project you are doing, a decentralized app, an enterprise platform, or a bespoke network, the choice of a rollup will determine the success of your blockchain project in the long term.