There is a massive financial ecosystem transformation occurring all over the world where conventional means of settling payments cannot keep up with the pace and complexity of modern transactions. Banks and other financial institutions are seeking more intelligence, quicker, and easier to deal with the money across the borders. This is where the swift blockchain settlement system is emerging as a powerful solution that combines the reliability of established financial messaging networks with the efficiency of blockchain technology.

Financial transactions through the distributed ledger technology could be provided with high levels of security and traceability in real time. Contrary to the traditional clearing systems that rely on a network of intermediaries, the blockchain-based settlement systems simplify the activities and minimize operational risks. This change is a new age of international banking where automation, speed, and trust work in unison.

Understanding the Concept of Blockchain-Based Settlement

A settlement system operated with the help of blockchain documents and verifies financial transactions on a common digital ledger. Individual transactions are cryptographically certified and stored indefinitely, forming an irrevocable ledger that cannot be changed without unanimity. This solution eliminates the reconciliation between the different databases and it also mitigates settlement delays to a great extent.

In combination with the current financial messaging systems, blockchain can facilitate the free flow of data between institutions. This is the benefit swift blockchain settlement system takes advantage of as it offers a safe bridge to banks and also introduces an element of automation with smart contracts. Such contracts have the capability of automatically executing a settlement, depending on specific requirements that are already established and, therefore, maintain precision and minimize the necessity of human computing.

Role of Blockchain Development in Modern Financial Infrastructure

Blockchain development is a very important factor in the evolution of financial settlement networks. The more developed blockchain systems have become interoperable, scalable, and regulatory. This will enable financial institutions to adopt distributed ledger systems without necessarily changing the whole set up.

Modern blockchain networks have the potential to manage large volumes of transactions effectively due to better consensus mechanisms and encryption protocols. This facilitates real time over border settlement and preservation of data integrity. The swift blockchain settlement system benefits from these innovations by offering banks a platform that merges established financial trust with decentralized validation. The use of blockchain technologies in financial modernization is more important as this technology evolves.

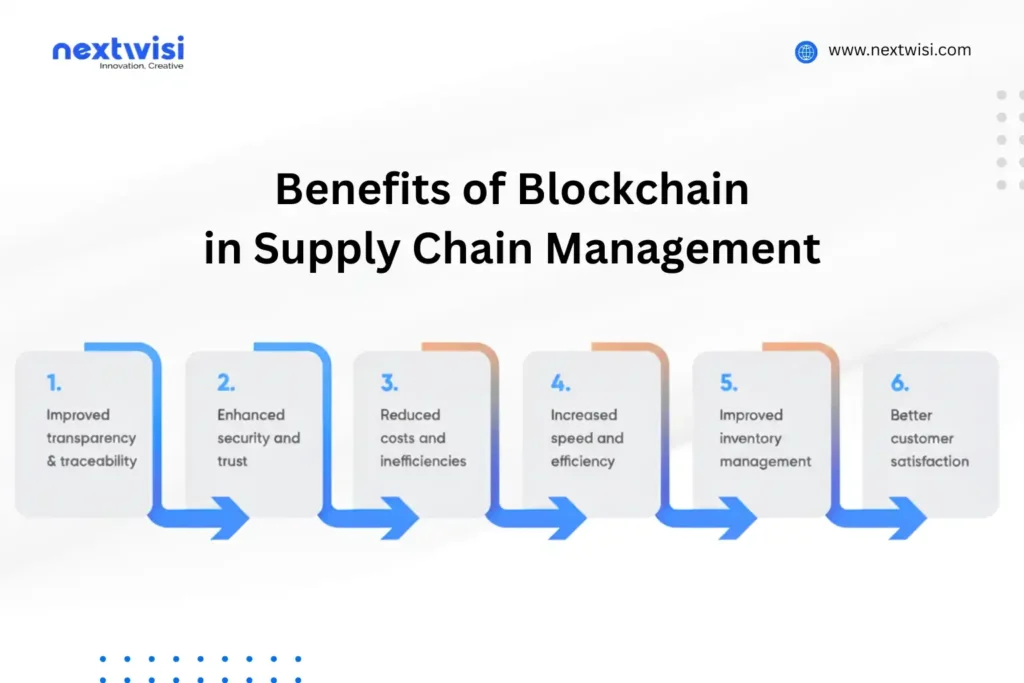

Key Benefits of a Decentralized Settlement Network

Transparency is one of the main benefits of blockchain-based settlement. All these transactions are stored in a common ledger that can be accessed by relevant stakeholders that lowers chances of disputes and enhances the process of auditing. Banking organizations can have better transparency of transaction flows thus enhancing risk management.

Another major benefit is speed. Traditional cross-border payments can take days due to intermediary banks and clearing procedures. Blockchain-powered systems enable near-instant processing by eliminating unnecessary layers. The swift blockchain settlement system also lowers transaction costs by reducing dependency on third parties and minimizing operational overhead.

Security is also very critical. Cryptography and consensus protocols are employed by blockchain to ensure that modifications are not made unauthorizedly. This makes the transaction environment tamper-proof which deter fraud to a large extent and makes the participants of the financial world more trustful.

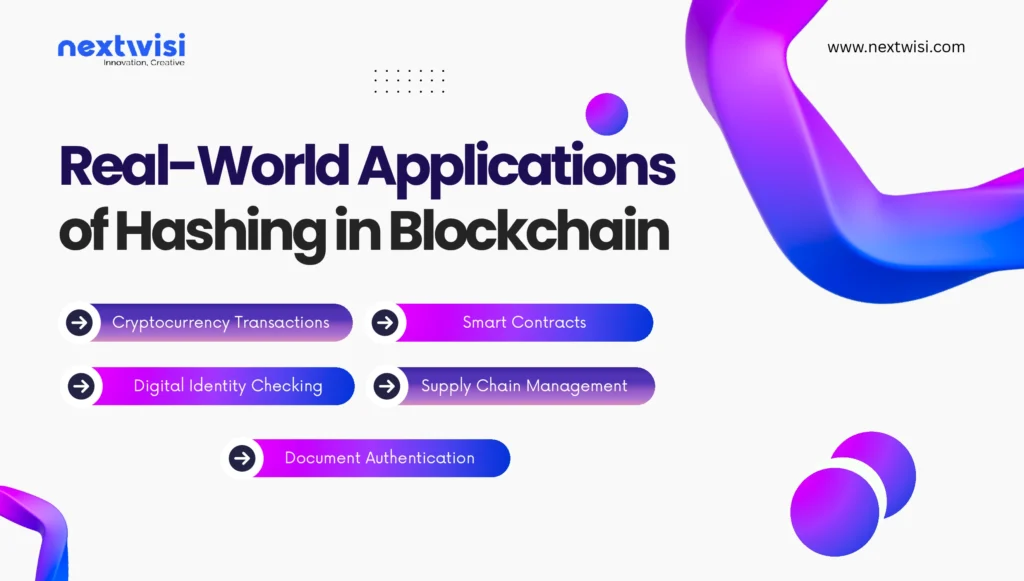

How Smart Contracts Improve Settlement Accuracy

In the blockchain-based financial systems, smart contracts hold a key position. These are self executing programs which automatically execute rules regarding transactions when conditions are met. As an illustration, payment can be discharged upon confirmation of goods delivery or by regulation.

Banks save time wasted in administration and human error by computerizing the settlement processes. The swift blockchain settlement system can integrate smart contracts to automate compliance checks, currency conversions, and final settlement actions. This has the effect of increasing efficiency and predictability in transaction outcomes.

Smart contracts also enhance uniformity in the financial operations. As the logic is hard-coded into the system, the logic remains the same set of determine rules and rules that are applied in all transactions and the system is fair and reliable.

Integration with Mobile App Development for Banking Services

With the increased digitalisation of financial services, the ease of access among the users is becoming a major concern. The mobile app development can be integrated with the banking to enable them to offer real time tracking of transacting and settlement of the customers. The mobile platforms allow users to check payment status, get notifications and handle digital assets safely on their devices.

The swift blockchain settlement system can be connected with modern mobile interfaces, making cross-border payments more transparent and user-friendly. Customers will have immediate confirmation rather than waiting days and enhance satisfaction and trust. It will be effective in this combination of both blockchain infrastructure and mobile accessibility to form a strong digital banking ecosystem.

Compliance and Regulatory Considerations

The financial institutions are regulated in a stringent system. Any settlement system should be in compliance with the Know Your Customer (KYC), Anti-Money laundering (AML), and data protection requirements. Blockchain technology can be used to increase compliance through the immutable history of transactions that can be audited.

Regulators will be able to see the right records without jeopardizing the privacy of data by having direct access to the transparent ledgers with cryptographic verification. The swift blockchain settlement system is designed to align with global regulatory requirements while introducing decentralized validation. This implies that it can be used in enterprise usage in various jurisdictions.

Also, blockchain interoperability enables two or more financial networks to interrelate safely. This provides regulatory harmonization without interfering with the current financial operations.

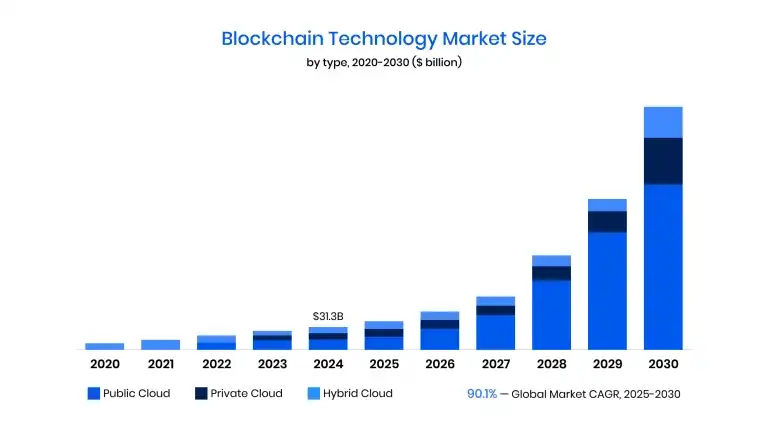

Cloud Solutions and Scalable Financial Networks

Any global settlement platform needs to be scalable. Contemporary financial networks are relying on cloud solutions to control the volume of transactions and stay highly available in the system. Cloud infrastructure allows blockchain-based settlement systems to dynamically increase or decrease resources as required.

The swift blockchain settlement system can leverage cloud environments to ensure reliability, disaster recovery, and real-time performance. Data analytics also run on cloud integration, so the banks can obtain insights regarding the tendency of the transactions, as well as, operational efficiency. This forms a future ready financial network that is capable of changing to increasing digital transactions volumes.

Future Outlook of Blockchain Settlement Systems

Financial business is shifting to instant and borderless transactions. With the trend of growing popularity of digital assets and tokenized securities, blockchain-based settlements will become indispensable in complex financial instruments. DLS provide the level of transparency and automation needed by this new digital economy.

The Shift blockchain settlement system will be instrumental in this change as it bridges the gap between the traditional banking organizations and the new financial technologies. Its compatibility of security, speed and compliance makes it an effective solution when used on a large scale basis.

Blockchain settlement would probably be extended to trade finance, insurance claims, and interbank liquidity management in the next few years. Such advancements will also contribute to greater confidence between the institutions and less friction in the operations of the global financial markets.

Conclusion

The development of blockchain based settlement systems is an indication of the revolution in the world of finance. Financial institutions can work towards efficiency and cost savings by substituting slow and fragmented methods of clearing with transparent, automated and secure networks. The swift blockchain settlement system demonstrates how blockchain can be integrated into existing financial infrastructures without disrupting established processes.

This system provides a contemporary method of cross-border settlement due to smart contracting, decentralized validation, and scalable cloud architecture. With the continued advancement of regulatory frameworks and the growth of digital finance, the settlement networks based on the use of blockchains will become the foundation of international transactions.

The organizations that prepare themselves to embrace this technology at an early stage will experience faster processing, reduced risks and more transparency. Blockchain settlement systems are becoming a necessity and not an option in a more interconnected financial world, which requires sustainable and secure global banking.